- By Demola Atobaba, Ado-Ekiti

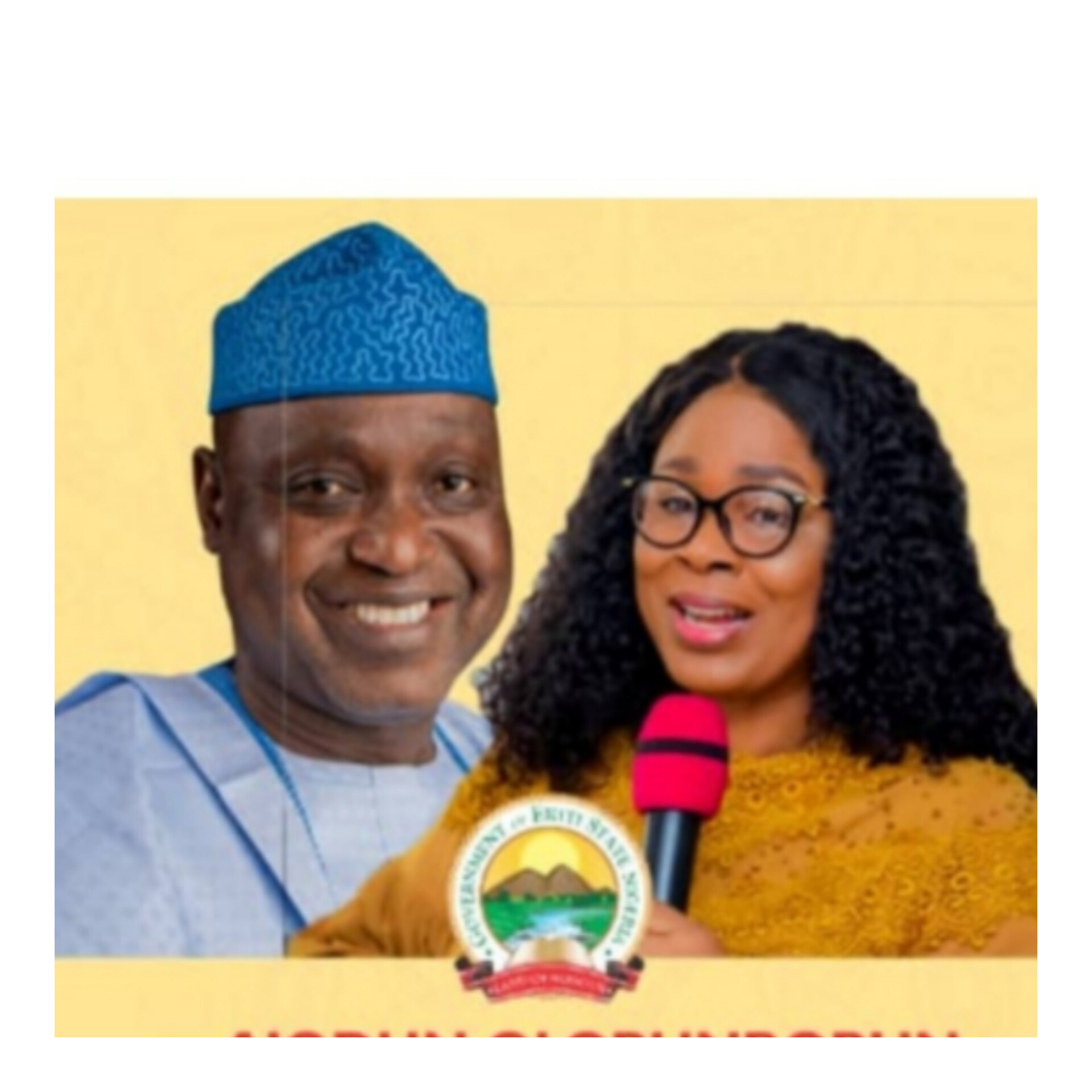

The Executive Chairman of Ekiti State Internal Revenue Services, Mr Niran Olatona has appealed to the residents of the state to cooperate with the officials of the establishment over the regular payment of their taxes.

EKIRS commitment to promote revenue harmonization, and also provide friendly environment for businesses to thrive in the state, was indicated while Olatona was addressing newsmen in Ado-Ekiti, the state capital.

The revenue boss noted that the revenue harmonization and improving the means of doing business are crucial steps towards attracting investors and promoting share prosperity which is one of the main objective of the current administration.

Speaking further, Olatona lauded Governor Oyebanji’s unrelenting efforts and commitment to continue to give rooms for business environment that foster economic, job creation and overall development of the ‘Fountain of Knowledge’ state.

His words: “The Internally Generated Revenue (IGR) of the state in the last one year has grown significantly. We’ll continue to appreciate the support of His Excellency, Biodun Abayomi Oyebanji, Mr Akintunde Oyebode, the State Honourable Commissioner of Finance and a host of others in this administration who have been great pillars. From an average of N650m monthly IGR, we are now one of the states that generate over N1b per month and with potential to do much more.”

According to him, “a lot of opportunities abound in this state where the eggheads of the nation are born. Our culture of being conservatively reserved has made many people erroneously believe Ekiti State is a Civil Servant State. Thank God the game is changing and those whose eyes don’t just look but can see are already keying in, strategically positioning themselves to get the best of the opportunities abounding from Agric to tourism, education, solid minerals and many more”.

Olatona encouraged members of the public to avoid fraudsters presenting themselves as middle men. With over 25 Tax Stations across the state, he said members of the public are safer if they relate directly with the officials of State Internal Revenue Service on their tax issues.

He stressed it that the Service has continued to invest in human capital development, continuously training staff and equipping them with the requisite skills and knowledge needed in the discharge of their duties. They are expected to be professional at all times.

Talking about the organisation’s zero tolerance to shady practices, he hinted that whistleblowers can reach the agency by sending email to chairman@ekitistaterevenue.com. Response would be received within 36 hours.

Addressing the issue of fake tax collectors, Olatona confirmed that his administration has introduced a modern technology in order to given a best approach to their daily operations. “We have introduced technology in our operations, collections, and administration in line with global best practices to ensure an efficient and effective Revenue Service. These tools assist in blocking revenue leakages and optimizing our operations while ensuring taxpayers can make payments and carry out other functions from the comfort of their homes and offices.

On the need to collaborate with the IRS, he said Ekiti people should see EKIRS as their servant agency saddled with the responsibility of generating revenue to benefit the state. He enjoin the people to thank God for a governor like BAO for efficient use of the resources of the state.

The revenue boss said “it is when we pay our correct taxes that we can task our government”. He reminded the people of the official inauguration of the State’s 3.6MW Independent Power Project (IPP) in Ado-Ekiti. This indeed marks a monumental stride in Ekiti State’s journey to illuminate every corner.

On some of the challenges faced by the organization, he said: “The informal sector is yet to understand that there is nothing like association income tax and group payment is not advisable”.

He promised to continually enlighten people through meetings with Ekiti kings, palace chiefs and market leaders and effective use of all available media, traditional and social media.

He also stated that tax payers have the right to object to tax assessment but they must be ready to provide correct and adequate records bearing in mind that EKIRS is equipped to verify claims.